Copper has long been an essential material in the electrical and construction industries. Its excellent conductivity, corrosion resistance and ductility make it ideal for wiring, power generation and a wide range of other electrical applications. However, over the past decade, the price of both new and recycled copper has been increasing at an alarming rate, causing ripple effects across many industries, particularly in the UK, writes Phil Wiltshire, Operations Manager of Pensdown, the electrical people.

Copper prices have seen a significant upward trend over the last decade. Several factors, including supply chain disruptions, increased global demand and geopolitical issues, have all played their role. In 2010, the price of copper was around $9,700 per metric ton, following a spike during the commodity boom of the late 2000s. After peaking in 2011, prices fell steadily, reaching $4,800 per ton by 2016 as the global market rebalanced following the Eurozone crisis and slowing growth in China.

However, copper prices began to surge again in 2020 due to a combination of factors, most particularly the COVID-19 pandemic, which saw disruptions to mining operations, especially in South America, which supplies a large portion of the world’s copper.

The growing demand for renewable energy, electric vehicles (EVs) and other clean technologies has also increased copper consumption, together with post-pandemic recovery efforts, such as massive infrastructure investments in countries like the US and China, which have led to skyrocketing demand.

By early 2024, copper prices soared to $8,400 – $8,800 per metric ton, according to market reports. Recycled copper has also seen a sharp rise in cost, closely following the price trends of newly mined copper.

For companies like Pensdown, these rising prices directly impact operational costs, project pricing and profitability. As a result, the UK electrical sector, which relies heavily on copper for wiring, transformers, electrical circuits and much more, is now facing several key challenges.

Rising costs for electrical projects

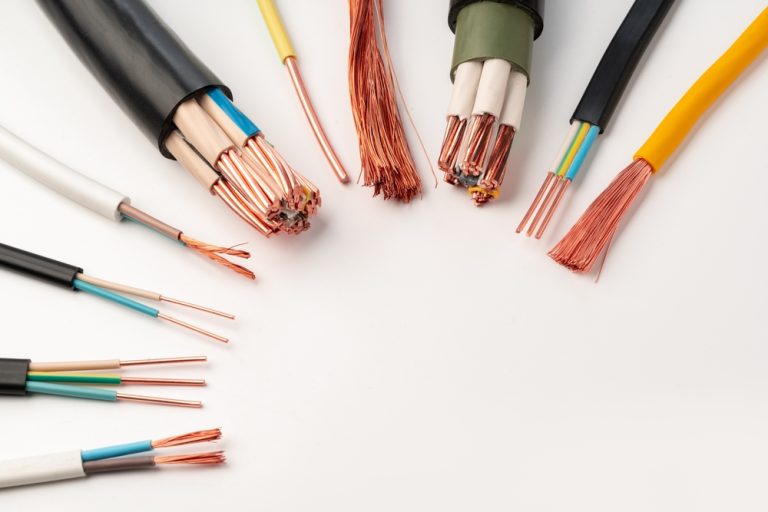

With copper prices soaring, the cost of electrical components has increased significantly. Copper wiring, cabling and circuit components are integral to electrical installations, meaning price hikes directly translate into higher costs for businesses and customers.

Electrical contractors, manufacturers and construction firms are already feeling the squeeze. For instance, a large-scale commercial building that might have required £50,000 worth of copper wiring in 2010 may now require £100,000 or more to complete the same project in 2025. These increased costs trickle down through the entire supply chain, eventually leading to higher prices for end consumers.

Infrastructure projects such as new housing developments, data centres and renewable energy plants also require vast amounts of copper. For example, electric vehicle charging stations, solar power installations and wind turbines are all copper-intensive. The increased costs of this metal could slow down the pace of these developments, or at the very least, increase their total cost.

Small and medium-sized electrical contractors are particularly vulnerable to the rising cost of copper. Unlike larger companies that may have the capacity to absorb price fluctuations or secure long-term contracts with suppliers, smaller businesses often lack such leverage. These companies face the challenge of either increasing their prices, which could hurt competitiveness, or absorbing the costs and seeing a hit to their margins.

While the immediate commercial implications of rising copper prices are clear, the future presents several significant challenges that will need to be addressed. The production of new copper is resource-intensive and has significant environmental impacts, particularly in terms of energy consumption and greenhouse gas emissions. As the UK government pushes towards more sustainable construction practices, the copper industry also faces pressure to adopt greener methods of production.

Recycling copper is a more sustainable option, as it uses significantly less energy than mining and refining new copper. However, even recycled copper is experiencing a price surge, as the growing global demand outstrips supply. As a result, businesses like Pensdown may need to explore alternative materials and more energy-efficient systems to remain competitive while maintaining environmental compliance.

The push for electrification

As we have heard, the growing demand for copper is partly driven by the global push for electrification and decarbonisation. As the UK aims to achieve net-zero emissions by 2050, copper will play an essential role in building the electrical infrastructure required to support electric vehicles, renewable energy and modern power grids. However, rising costs threaten to slow the pace of these developments.

Meeting the UK’s ambitious climate targets will require innovative solutions to manage rising material costs while continuing to expand green infrastructure. All this means that electrical companies like ours must remain agile, adopting new technologies and exploring alternative materials to reduce their dependency on copper.

We, like the rest of our industry, must adapt to these new market realities, whether by passing on costs to customers, exploring alternative materials or finding more efficient ways to manage copper usage.

It also means that while the global demand for copper is expected to continue rising in the coming years, driven by the push for electrification and green energy, the industry will need to innovate to overcome supply constraints, price volatility and environmental concerns. For UK businesses, this means staying agile, investing in sustainable practices and keeping a close eye on the evolving market for copper and other essential materials – because decisions made today will shape the future of the UK electrical industry for years to come.

For further information visit: www.pensdown.co.uk