Alright, let’s be real for a second — managing money in business isn’t glamorous. It’s not the fun part of running a company. It’s not landing a client, or launching a shiny new product, or getting that first sale notification.

Nope. It’s bills, receipts, taxes, and all the boring-but-essential stuff that keeps the lights on. But here’s the kicker: if you don’t get this right, all those exciting wins can vanish faster than you’d believe.

The thing is, the modern business world doesn’t really give you much room to wing it. Cash flow can look fine today and go sideways tomorrow. One late client payment, one unexpected expense, and suddenly you’re sweating payroll.

That’s why “managing money smarter” is less about being a genius with numbers and more about setting up systems, checking in often, and not letting the small leaks drain the whole ship.

Busy Work vs. Real Control

Here’s something I see way too often: business owners buried in spreadsheets, convinced they’re “on top of things.” But really, they’re just shuffling numbers around like busy bees with no honey at the end. That’s busy work — and it’s a trap.

Real control isn’t spending three hours copying receipts into Excel. Real control is glancing at a dashboard and knowing, in seconds, where your money’s going and whether you’re in the red or the clear.

Big difference. And the only way to get there is to let software do the grunt work instead of you. (Trust me, your future self will thank you.)

1. Envoice (envoice.eu)

Let’s start with Envoice because, honestly, it’s underrated. Think of it as the tool that makes receipts stop being your problem.

Snap them, send them, done. Expenses flow in automatically, approvals happen without ten back-and-forth emails, and your accounting software stays synced. No drama.

If you’ve been hunting for business expense software that doesn’t feel like it was built in 2004, Envoice hits the sweet spot.

It’s simple enough that you’ll actually use it, but powerful enough to keep your books clean. Plus, it integrates with the big players, so you’re not stuck doing double work.

2. QuickBooks Online

Now, QuickBooks isn’t new. Your accountant probably already lives in it. But QuickBooks Online deserves a mention because it’s basically the Swiss Army knife of small business finance. Invoices, payroll, tax prep, reports — all in one spot.

The real killer feature? Reports that make sense. You don’t need a degree in accounting to read them. You get charts, trends, cash flow snapshots… basically, everything you need to know whether you’re okay or headed for trouble.

It’s like checking your car’s dashboard instead of popping the hood every time you want to know if the engine’s still running.

3. Dext

Dext does one thing really well: it makes receipts disappear into your books without you typing a single digit. You take a picture, upload, and boom — the data’s in your system. For businesses drowning in paper, it’s a sanity-saver.

But here’s the thing: it’s not the only choice out there. There are plenty of Dext alternatives — Envoice, Expensify, AutoEntry, you name it.

Some are cheaper, some are friendlier, and some just click better with certain industries. Point is, don’t assume Dext is automatically the “best.” Test a couple out and see what feels natural for your workflow.

4. Expensify

If you’ve ever chased employees for receipts, you’ll appreciate Expensify. It’s built for teams on the move — sales reps, travelers, remote workers. Employees snap a pic, upload, and it goes straight into the system. Managers approve in seconds. Done.

What’s nice here is how fast reimbursements happen. Nobody’s left waiting weeks for their money. And that alone keeps morale high. Because let’s be honest: nothing kills motivation like footing business bills out of your own pocket and waiting forever to get paid back.

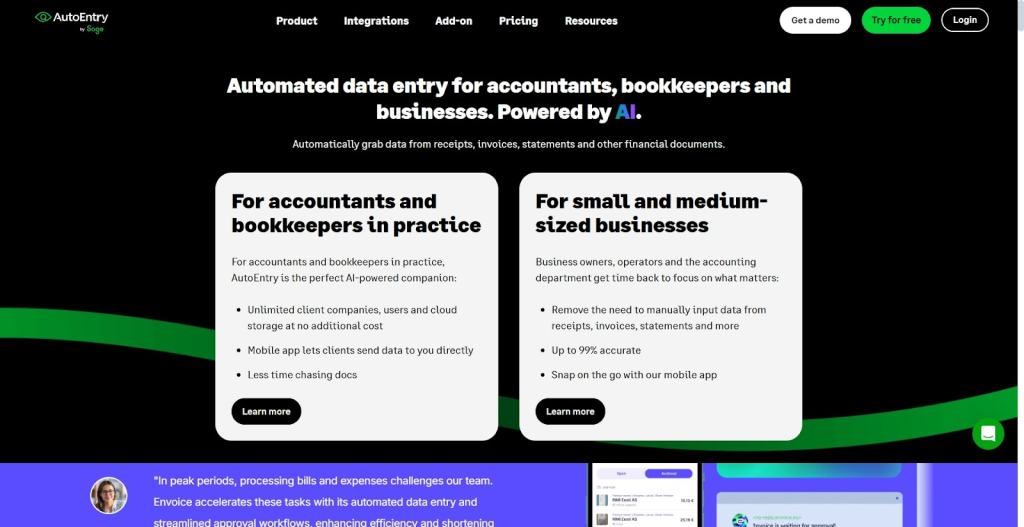

5. AutoEntry

AutoEntry is kind of the quiet workhorse. It doesn’t just handle receipts — it does invoices, line items, and even bank statements. That’s right, the whole messy pile. It integrates with the big platforms (QuickBooks, Xero, etc.), so it slides right into your setup.

The best part? Accuracy. Fewer fat-fingered mistakes, fewer late nights fixing typos. You get cleaner data without extra effort. It’s not flashy, but man, it’s effective.

Classic Money Traps (Don’t Fall for Them)

Look, most businesses don’t fail because the idea was bad. They fail because the money side wasn’t handled. Some of the most common slip-ups:

- Mistaking revenue for profit (big one — cash coming in doesn’t equal cash left over).

- Forgetting about those sneaky subscriptions that auto-renew forever.

- Dumping a year’s worth of paperwork on your accountant in tax season (they’ll hate you for it, by the way).

These aren’t hard to fix. It’s about consistency. Review monthly, cancel junk you don’t use, and keep your numbers up-to-date. Small habits beat last-minute panic every time.

Culture Matters Too

Here’s a curveball: money management isn’t just the finance team’s job. It’s cultural. If your staff treat expenses like Monopoly money, you’ll bleed cash no matter how good your software is. The fix? Make money awareness part of the culture.

Doesn’t mean putting the whole ledger on display. Just share the basics — department budgets, spending goals, progress. People act differently when they can see the impact of their choices. And don’t overcomplicate expense policies. Simple rules stick, confusing ones don’t.

Spending Smarter Isn’t Always Spending Less

This one surprises people: sometimes, smarter money management means spending more. On better tools, on solid advice, on training. If the expense saves time, prevents bigger mistakes, or brings in more revenue, it’s not a waste — it’s an investment. Simple as that.

So next time you hesitate over a new tool or consultant, ask: will this pay for itself in saved time or avoided headaches? If the answer’s yes, go for it.

Keep Things Flexible

Markets shift. Regulations change. New opportunities pop up. If your money systems are rigid, you’re going to snap under pressure.

Pick tools and processes that scale, integrate, and adapt. Think of it like buying jeans with a little stretch — they’ll fit a lot longer than the stiff ones.

Final Thoughts

At the end of the day, managing money smarter isn’t about perfection. It’s about being consistent, cutting out the busy work, and using tools that actually make your life easier.

Envoice, QuickBooks, Dext, Expensify, and AutoEntry — each tackles a different headache. Try them, keep what fits, ditch what doesn’t.

The real payoff? Fewer 2 a.m. panic sessions with spreadsheets, fewer “where did the money go?” moments, and more confidence steering your business forward. And honestly, that’s worth way more than another pile of color-coded Excel tabs.