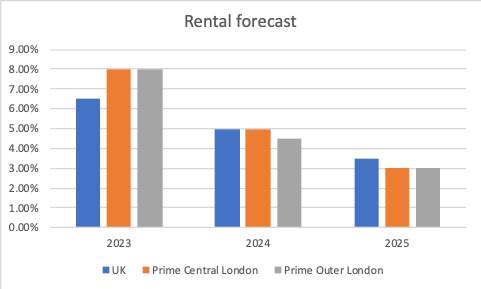

UK house prices dipped in 2023 for the first time in 10 years as the cost of borrowing soared and fewer people chose to move. By the end of 2023, we anticipate that house prices will have fallen by -2% in London and by -3% across the UK, suggesting a slowing down in the market rather than a notable correction.

House price growth over the last decade has been driven by ultra-low interest rates that made mortgages – and therefore home ownership – more affordable. It is therefore no surprise that the market has cooled as a result of the 14 interest rate rises that the Bank of England implemented between December 2021 and August 2023, moving the base rate from 0.1% to 5.25%.

Although the era of super-low interest rates is now behind us, with a degree of pain as some homeowners transition from the lower rates to the current rates, the Bank of England is now unlikely to raise interest rates further. It is even projecting small cuts in 2024 (to 5.1%) and 2025 (to 4.5%), which should allow the property market to recover as mortgage rates also start to fall.

Beyond this, the drivers of house price growth are somewhat muted. Despite falling inflation, economic growth has stalled and is not expected to recover quickly over the next two years, and unemployment is slowly creeping up. In addition, a General Election being called at some point before the end of next year, creates added uncertainty, especially for the top end of the market, which is often affected by changes to tax rules.

Reflecting the sluggish economic outlook, projections for house prices over the next two years are similarly subdued, although any interest rate cuts or tax incentives could quickly change this. Chestertons forecasts that UK house prices will experience a slight decline of -0.3% over 2024, while London prices will show growth of 1.8% due to the higher number of cash buyers that are less affected by the higher interest rates.

The prospect of a slightly stronger economic outlook from 2025 feeds through to a more meaningful uplift in house prices. We forecast that this will result in growth of between 3.5% and 4.5% across London and the UK. However, we caution that any house price growth is more likely to be slow and steady rather than spectacular.

Source: Chestertons

Pace of rental growth to moderate as supply catches up with demand

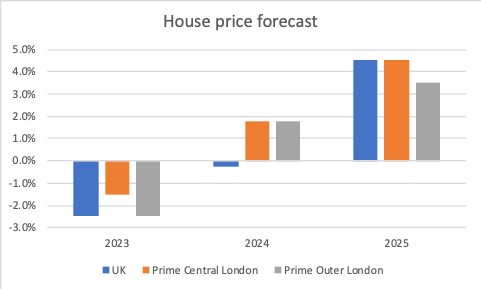

In contrast to house prices, rents are forecast to have increased by 6.5% across the UK and by around 8% in London in 2023. Rental growth has been driven by an imbalance between limited supply of new rental properties coming to the market and a growing population of renters.

Chestertons believes that rents are likely to rise further over the next two years as employment remains high and competition for rental properties is sustained. However, we will see more supply coming to the market as rising yields have started to encourage more landlords back into the market and some financially-stretched homeowners are choosing to put their properties on the rental market in reaction to the jump in mortgage repayments. Therefore, whilst we do not foresee a change in demand, the addition of new supply is likely to have a dampening effect on rental growth over the next two years. As a result, Chestertons forecasts a 5% increase in rents across the UK and London in 2024, followed by a drop to 3-3.5% in 2025 as the accumulation of new supply begins to soak up demand.