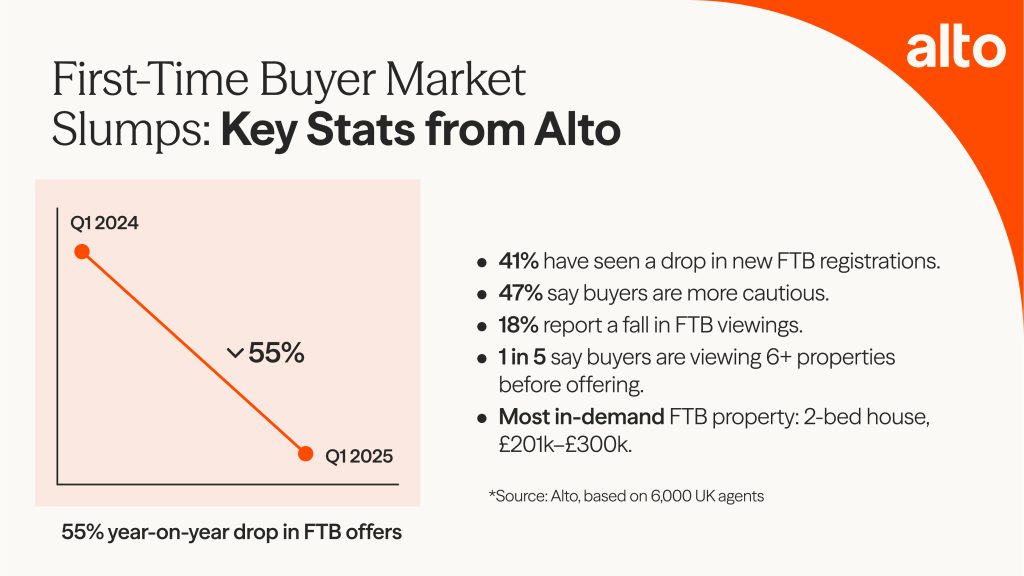

First-time buyers have slammed the brakes on property deals – with new figures revealing a 55% drop in offers this quarter compared to the same time last year.

Exclusive market data from leading estate agency software provider Alto, based on activity across its 6,000 UK estate agents, reveals a sharp downturn in FTB demand since the Government’s April 1st stamp duty changes.

On April 1st, the Government cut stamp duty relief for first-time buyers, reducing the tax-free threshold from £425,000 to £300,000. The change means many now face thousands more in upfront costs when trying to get on the ladder.

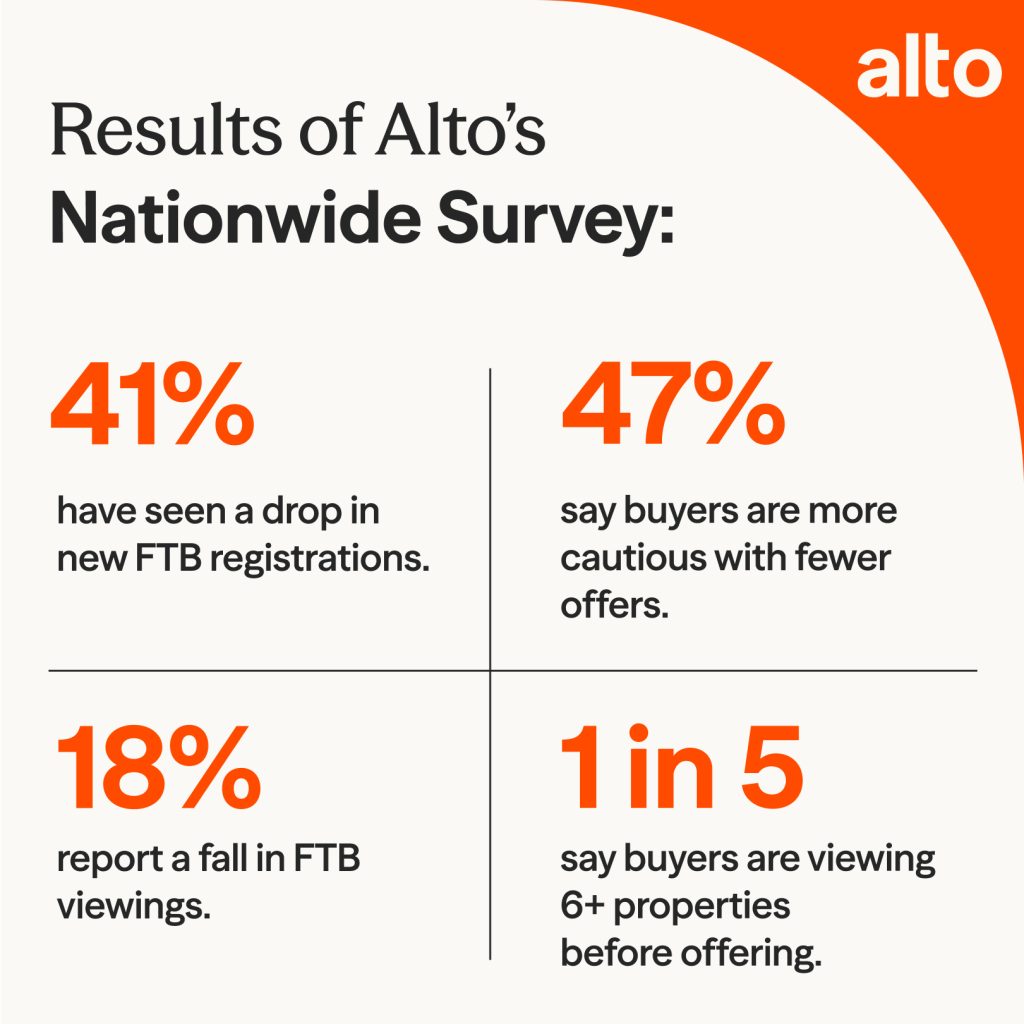

A nationwide poll of 250 agents – also by Alto – lays bare the the impact of that change:

- 41% have seen a drop in new FTB registrations

- 47% say buyers are “more cautious”, with fewer offers being made

- 18% report a fall in FTB viewings

- 1 in 5 say buyers are viewing 6+ properties before offering – a sign of growing indecision

- Two-bed houses remain the most in-demand FTB property, typically priced £201k–£300k

One South East-based agent told Alto: “Home buyers are slashing their budgets, dragging their feet – or walking away at the eleventh hour. I haven’t seen this much hesitation in years.”

While FTB registrations surged +70% quarter-on-quarter in early 2024 – likely to beat the changes -that momentum quickly fizzled. By Q1 2025, offers had plummeted 55% year-on-year. For many agents, this sharp fall in first-time buyer activity is hitting revenue, with fewer deals reaching completion and pipelines drying up.

Now, over half (56%) of agents are calling on the Government to step in. Their wishlist includes:

“First-time buyers were already under pressure with rising living costs, high interest rates, and lenders tightening up,” said one London-based agent. “The stamp duty shake-up was the final straw. It tipped already-stretched buyers over the edge.”

Alto’s data shows FTBs now account for less than 20% of viewings – underlining the struggle to convert interest into action. In response, some agents are shifting focus to more active segments – including second-steppers and landlords – to keep deals flowing.

“This data should be a wake-up call for policymakers,” adds Alto CEO, Riccardo Iannucci-Dawson. Agents are already seeing the fallout with first-time buyers vanishing from the market, and deals falling through.

“Alto’s market dashboards help agents spot shifts like these early — giving them the insight they need to adjust strategy and better serve clients in changing conditions. However, if the goal is to build a fairer, more accessible housing market, we urgently need more targeted support for first time buyers. Agents can’t shoulder this alone – the system needs to meet them halfway.”

Alto will be hosting a webinar for agents titled “Stamp Duty & the FTB Slowdown: What Estate Agents Need to Know” to explore what the data means for the market — and how agents can respond. Register here.