3 in 4 People Can’t Afford To Buy On The Open Market

New research from the UK’s leading first time buyer property portal, Share to Buy, reveals that the ongoing cost of living crisis is having a significant impact on the ability of many people to become homeowners on the open market this year.

- 82% of people are worried about rising interest rates

- 80% of people said that the cost of living crisis has reduced how much they can save for a deposit each month

- 77% of people believe that they couldn’t afford to buy a property on the open market

- 73% of people blame saving enough for a deposit, rising interest rates and high mortgage rates as their biggest barriers to homeownership

- 65% of people said that the cost of living crisis has delayed them buying a home

- 35% of people admitted they’re looking for a cheaper home due to the cost of living crisis

“These findings from our recent survey of over 2,600 budding buyers highlights how the cost of living crisis is impacting the dream of homeownership for many this year,” says Nick Lieb, Chief Operations Officer at Share to Buy. “High interest rates coupled with the general cost of living, is creating significant financial barriers for aspiring home buyers to purchase their dream home on the open market.”

82% of people are worried about rising interest rates

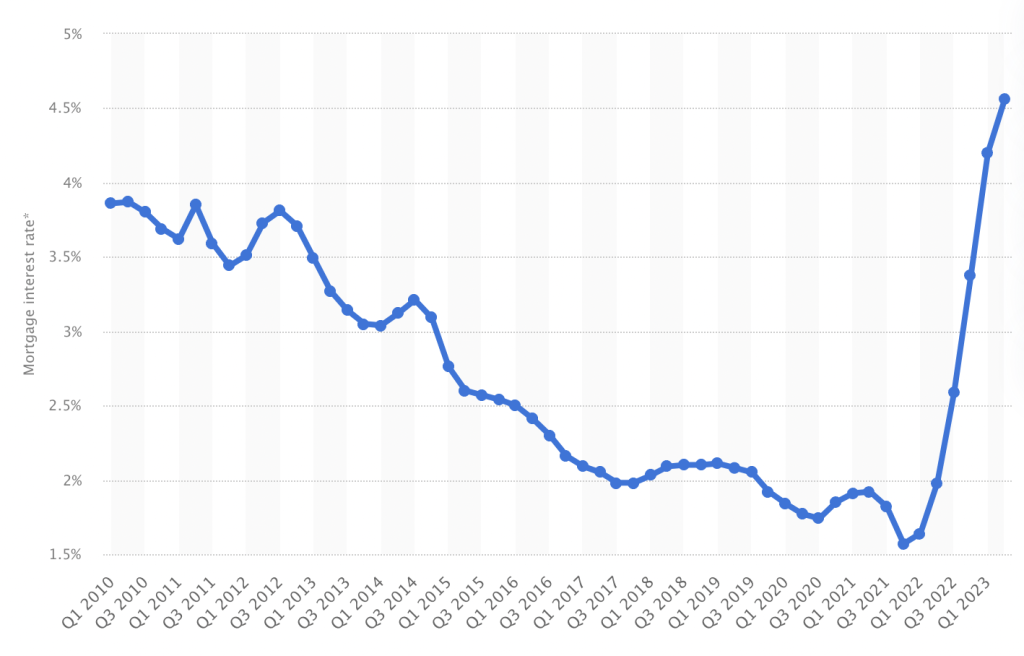

Statista: Average mortgage interest rate in the United Kingdom (UK) from 1st quarter 2010 to 2nd quarter 2023

Rising mortgage rates have been dominating news headlines, and for good reason. After a decade of steady decline, mortgage interest rates in the UK took a sharp turn upwards in 2022, almost tripling between the fourth quarter of 2021 and the second quarter of 2023 (4.56% vs. 1.63%). This dramatic shift has had a significant impact on homeownership aspirations and affordability.

80% of people said that the cost of living crisis has reduced how much they can save for a deposit each month

For many, owning a home seems further away than ever. According to Share to Buy research, a staggering 8 out of 10 people say the cost of living crisis has squeezed their ability to save for a deposit. Nearly half (45%) of people admitted to having less than £10,000 saved for a deposit, despite over 30% of those surveyed saving for three to five years.

This paints a concerning picture for aspiring homeowners, with 65% of people admitting that the cost of living crisis has delayed them buying a home, highlighting the need for innovative solutions to bridge the widening gap between saving goals and soaring property prices.

77% of people believe that they couldn’t afford to buy a property on the open market

The dream of owning a home seems to be slipping further out of reach for many. A staggering 77% of people believe they are unable to afford a property on the open market, and 76% of single individuals believe buying solo is simply unattainable. 73% of people identify saving for a deposit, high mortgage rates and rising interest rates as their biggest barriers to getting on the property ladder, highlighting the immense strain the current economic climate is placing on first time buyers.

The cost of living crisis and rising interest rates are clearly taking a toll on homeownership aspirations. With limited savings capacity and soaring property prices, many individuals are struggling to bridge the gap between their dream and reality.

Nick Lieb adds: “These findings highlight the urgent need for more affordable housing solutions to help those struggling with the rising cost of living, especially as traditional options become increasingly out of reach.”

“While the current market presents challenges, alternative homeownership schemes such as Shared Ownership can pave the way and help people onto the property ladder. By providing different options and offering support to those starting out on their home-buying journey, we can help more people turn their dreams into reality.”

Shared Ownership offers an alternative path to homeownership, allowing buyers to purchase a share of a property with a smaller deposit and lower monthly payments compared to traditional mortgages. These schemes can help eligible individuals and families overcome the initial financial hurdle and achieve their home-buying goals even in challenging economic times.