Introduction

In the ever changing world of finance, you’re going to need some helpful tools for stock analysis to gain the best results. As an experienced trader, you want to advance in ways that will revolutionize your day-to-day trading You may own a business and need to make informed investment decisions… But maybe you’re just brand new and excited about the stock market regardless of where you are there’s no denying that it takes resources.

In this article we give you the 7 best stock analysis tools on the market today, hand selected to provide you with the information necessary for wise investments. We’ve broken down the best of the various options by features, pricing, user experience and overall fit and finish so that you have everything you need when making your own decision. Jump in and find out which stock analysis tools can help take your investing to the next level!

Website List

1. BestStock AI

What is BestStock AI

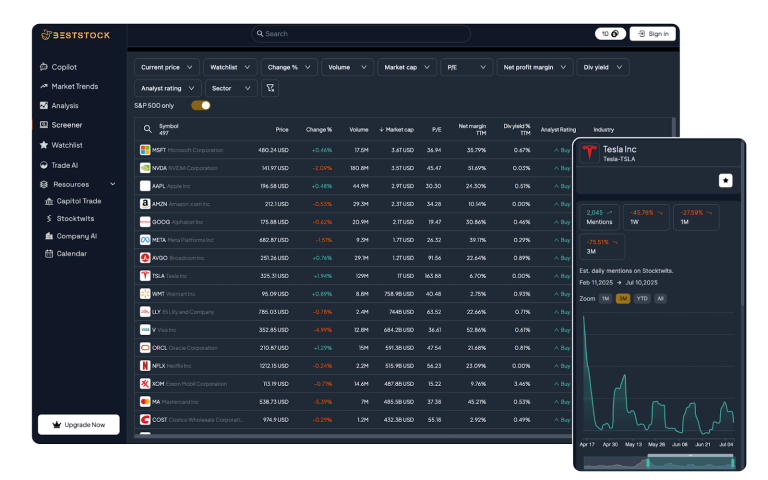

BestStock AI is an artificial intelligence powered stock analysis platform enabling automated financial data analysis for investment teams. Through automating financial data-analysis, and insights into decision-making, the firm is assisting its users by making fact-based decisions in an easier and faster way. Powered by complete corporate financial intelligence and daily AI analysis, BestStock AI provides investors with a solution to simplify their research and anticipate optimal investment strategy. In addition, BestStock AI provides access to a Capital Gains Tax Calculator, enabling users to easily estimate tax obligations and maximize investment returns.

Features

- AI-based financial analytics to ensure no manual effort is required for generating insights using data.

- Full US stock data financials, earnings and transcripts, curated research among others for making better informed investment decisions

- Advanced financial research tool to your statistical and business analysis Tool.

- Streamlined data organization and analysis to help investment teams ingest information intuitively

- Real-time market intelligence updated daily with trends and insights driven by AI JSBracketAccess

Pros and Cons

Pros:

- AI powered analysis provides actionable insights without the need for human labor

- Full US stock financials and earnings transcripts

- A frictionless research process means investment teams work more efficiently

- Updates every so often to give you the latest features and perspectives

Cons:

- It’s not the most economical option for financial analysis apps.

- Some activities can be done off-line, the ability to retrieve and manipulate data.

- It’s a little hard to imagine, but unlocking it is a time- and effort-invested challenge.

2. Trendlyne

What is Trendlyne

Trendlyne is a smarter version of the stock market. It focuses on supporting users with critical information and data to make intelligent investment choices, empower them come out ahead. Offering tools such as portfolio tracking, tracker for insider trades, and personalized watchlists, Trendlyne provides a host of valuable resources for beginners and experts alike.

Features

- Current market news to keep you updated with the latest financial information toward better investment decisions and successful trading strategies

- analysis of the market indices to see the big picture of financial trend.

- Easy to operate interface for quick access and hassle free trading process

- High level of details with historical data to make better decisions

- Real-time alerts and notifications to help you capture trading opportunities or avoid losing strategies

Pros and Cons

Pros:

- Wide variety of tool including alerts, reports & scanners for informed decision making

- Real-time data and insights, keeping you up-to-date on market trends.

- Clean and intuitive user interface that will enable you to manage your stock orders quickly.

- Variety of options to suit all user needs and pocket sizes.

Cons:

- Cannot tailor features to individual investment strategies

- May be overwhelming to beginners because of large feature-set

- Infrequent delays on the updates of data during high traffic periods

3. MarketBeat

What is MarketBeat

MarketBeat is a full-service, digital platform providing stock market news, analysis and research with a focus on small cap stocks and cryptocurrency. It’s primary goal is to provide users with timely information and insights so as to inform investment decisions. With real-time market data, facts, charts, information and guidance from well-qualified experts MarketBeat is a great place to explore whether you should invest or not.

Features

- AI analysis that uncovers tech stocks which are overvalued and, thus, good sell candidates

- Market Analysis on an Intrinio level they can use to capitalize emerging trenfs and opportunitties

- Uninterrupted coverage of all stock leaders making news and in a position to move – multiple times a day plus access to MarketSmith screener actionsSUCCESSFUL STOCK HUNTINGGet timely chart analysis and information on any new buy or sell opportunity.

- Strong data on price targets and stock performance to aid in timely investment decisions

- Expert analysis and commentary to make sense of today’s biggest stories.

Pros and Cons

Pros:

- Intelligent, curated contrarianism on oversold and undervalued tech stocks

- Coverage of multiple industries including energy, cyber security and rare earth stocks

- Market pulse, expert analysis and smart data help you cut through the noise to spot trends, risks and opportunities.

- General upside potential in a rebounding market

Cons:

- Market volatility may raise the risk for investors

- Some stocks might be highly speculative and not appropriate for conservative investors

4. Zacks

What is Zacks

Zacks Investment Research is a dynamic web-based platform offering the latest stock research, market insights and investment ideas. Its primary goal is to share proven investment ideas and market insights to help readers make informed, data-driven investment decisions in the stock market. Through its cutting-edge approach to the analysis of investment opportunities, based on many years of research, Zacks offers investors an education as they pick stocks and feel safer about their investments.

Features

- In-depth analysis by industry authorities to help you understand how today’s market conditions are likely to affect your business

- In-depth coverage on what economic data points mean to the market and how metal price are affected by them

- Strategic Advice custom designed to make investment decisions better

- Regular comments on market movements to keep you ahead and informed

- Deep dives into finance concepts simplified for even the most complex ideas

Pros and Cons

Pros:

- Possibility of a rally in the stock market as new Fed rate cuts kick in

- The potential for a surge in consumer spending and investment

- Long term positive economic outlook with short term chaos

- Detailed analysis from experienced financial planners

Cons:

- Ambiguity about the effects of rate cuts on various sectors

- Danger that markets would become too dependent on changes in monetary policy

- Potential short-term volatility Before substantial returns emerge

5. Seeking Alpha

What is Seeking Alpha

Seeking Alpha is a platform for investment research, with broad coverage of stocks, asset classes, ETFs and investment strategy. It includes unlimited access to breaking stock news, in-depth ratings and analysis, powerful tools to identify new investments and portfolio management. Through its dominant and diverse base of contributors/analysts, Seeking Alpha reports all the news daily to thousands of small-cap investors.

Features

- Free access to the breaking stock news keeping you in touch with the market conditions at no cost

- In-depth an and robust stock ratings from a thriving community of investors

- Extensive market coverage with data for US, worldwide and futures (ECT) to help make decisions

- Easy account creation to ensure a smooth onboarding experience

- Timely updates and observations on market developments to support investment decisions

Pros and Cons

Pros:

- Free access to breaking stock news

- Expert analysis and strong stock ratings from an informed community

- The latest financial news, including coverage of commodities and futures markets

- User-friendly account creation process

Cons:

- The amount of analysis might not be comparing to paid services

- The quality of insights may vary due to a dependence on contributions from the community

- May delayed news during high-volatility events

6. TipRanks

What is TipRanks

TipRanks is a financial technology platform that allows investors to see filtered COPPERFLAG reports based on analyst recommendations. Its primary function is to bring greater transparency to the stock market. Rank analysts, view public and private tips & opinion, discover which company is inflating your pensions and check the sentiment of a sector quickly all at one place. Using sophisticated algorithms and up to the minute big data, TipRanks provides an intuitive way to effortlessly search stocks by specific experts and calculate your investments remotely smarter.

Features

- Analytics technology that informs decision making and point of view

- Simple, convenient, and easy to use interface for browsing.

- Power scalability for your growing business requirements

- Real-time collaboration features that boost team work and productivity

- Complete set of training materials and documents for an easy onboarding and support

Pros and Cons

Pros

- TipRanks combines expert analyst opinions with insider activity and hedge fund moves to provide a 1-10 score of how smart the Street is so you can easily check if your favourite stock is up to snuff.

- The analyst ranking system provides a quantitative and comparison-performing measure to determine the top Wall Street experts.

- It is indeed covering the Global markets (US, UK, Australia etc), collating the latest price target and consensus recommendations.

Cons

- Advanced functions such as top analyst filters and unlimited alerts are available only with a paid subscription, leaving free users wanting.

- Heavy on data, beginners might be scared off by all the numbers and calculate overload.

- There are significantly more analysts than large-cap stocks, some opportunities will be flying under the radar.

7. MarketWatch

What is MarketWatch

MarketWatch is a financial information website that provides real-time summary information about markets, including the stock market, the bond market and investments; purposes include monitoring the investment performance of stocks. It is designed to provide a general introduction to financial markets for investors and investment professionals of all levels. MarketWatch With in-depth financial reporting and analysis, MarketWatch covers a full range of news topics – from breaking news to corporate announcements to everything impacti.

Features

- Easy to use interface designed for reduced user clicks and quick navigation through app types

- Strong security measures to keep your data safe and comply with regulations

- Workflows that flex with your specific business requirements

- Live collaboration tools to help improve team productivity and communication

- Analytics platform to monitor performance and results

Pros and Cons

Pros:

- It offers full, uninterrupted access to real-time quotes, news & market data as well other promotional services.

- The interface is neat, intuitive and accessible to all types of investors.

- It compiles material from Dow Jones Newswires, Barron’s and other trustworthy sources.

- The site provides useful snapshot of market opinion and community feedback.

- It has some handy elementary screeners and some simple watchlist tools.

Cons:

- The analytic charts and tools are not as elementary in comparison to professional platforms.

- Extensive fundamental data and fancy metrics are either known to a select few or come with a paywall.

- The analysis on offer is usually more newsy than proprietary or deep.

- The tracking portfolios and alerts are pretty basic.

- The platform best excels in terms of news aggregation and not so much advanced technical or fundamental analysis.

Key Takeaways

- The best means of investing stocks depends on your investment style, knowledge and risk tolerance.

- When assessing potential investment opportunities, you need to take into account historical performance and market trends along with a stock’s price.

- Real-time data and research tools can do wonders for your plan and execution of that plan.

- A great interface and available tools are make-or-break for investors to analyse stocks whether beginners or veterans.

- Regular updates and new analysis tools, suggest this is a strong and progressive stock analysis platform.

- Knowing the regulatory environment and how your analysis tools are prepared to meet regulations is crucial for investment practice.

- Interact with Investment communities and leverage quality educational resources to enhance your stock analysis skills and increase confidence.

Conclusion

Finally, with the above reviews of top 7 solutions on stock analysis which are available in the market today, you can make a smart decision for a logical pick. All have their own strengths, with different benefits and features that you can take advantage of – which is why we start every project with a consultation process. With powerful research tools and round-the-clock support, trading has never been easier with these best trading platforms.

The stock analysis-factor terrain is changing quickly with features and fixes added at regular intervals. We suggest you begin with solutions offering a close-in fit to your immediate trading requirements and potential to expand and adapt as your strategies develop. Keep in mind the most expensive is not always the best fit, and likewise, the system with all the features might not be everything you need depending on your individual needs.

Use free trials, demos and trial versions to get a feel for these tools yourself — and contact customer support teams if you have any questions. A good stock analysis software will keep the trader up to date with that information, as speed is key in trading or investing for that matter. Begin your path to smarter investing now!