Knight Frank, the UK’s leading independent real estate consultancy, has released some research in the European Quarterly, Commercial Property Outlook (Q3 2017) that proves a strong quarter last year has put 2017 European investment volumes on course to beat 2016. A total of €47.4 billion was invested in European commercial property in the third quarter of 2017, 13% more than in the same quarter of 2016.

This strong performance took the European commercial investment volumes for the first three quarters of 2017 to €144.4 billion, up by 3% year on year. Savoystewart.co.uk discovered the countries that show the most interest in investment in Europe.

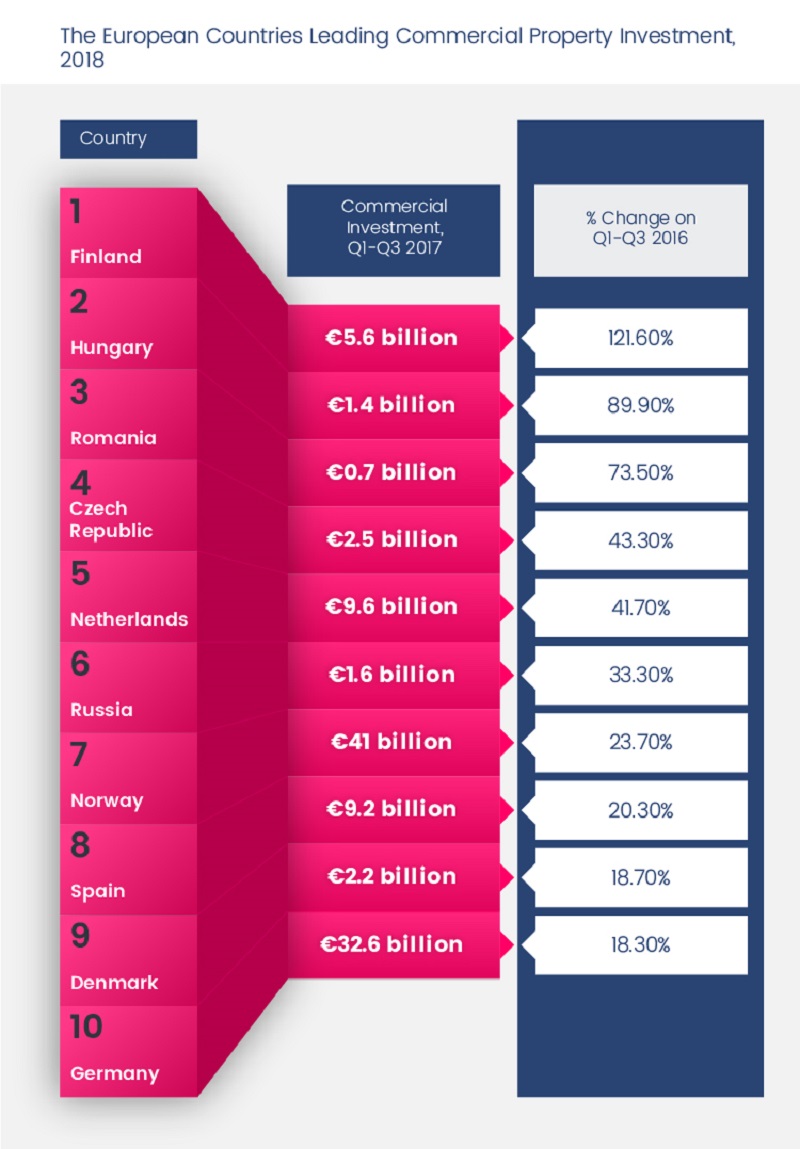

The most notable country was Finland, with a total investment of €5.6 billion, a rise of 121.60% on figures from 2016. Hungary with 89.90%, Romania with 73.50%, the Czech Republic with 43.30% and Netherlands with 41.70% followed, with considerable increases measured.

Although it misses the top ten for highest commercial investment volumes, the UK received a €37.6 billion in commercial investment in the first three quarters of 2017, which accounts to a 2.80% rise on 2016. This recovery has been primarily driven by the sale of large assets in London to overseas buyers, particularly in Hong Kong.

Furthermore, the UK’s position as a strong contender in commercial property should not be overlooked, especially not when other European countries are experiencing catastrophic falls in commercial investment volumes. The top 3 such countries are Ireland with -58.30%, Sweden with -38.60% and Switzerland with an average of -35.50% fall in investment figures.

“This rise and fall could reflect how investors are beginning to look toward locations outside of populist countries; places which may offer a renewed energy and stability to commercial business in uncertain times,” commented Darren Best, managing director at Savoystewart.co.uk.

“I believe the top ten countries will certainly be commercial locations to watch in 2018. But what is also crucial to note, is that investment in commercial property in Europe is thriving, overall – and the UK plays a large part in that,” he concluded.

Another interesting discovery from savoystewart.co.uk includes the top 5 preferred sectors for investors in 2018, which are Logistics and Industrial (51.0%), Specialist – including automotive/student/healthcare – (28.3%), Office at 15.2%, Hotel (3.4%) and Retail with 2.1%.