Marlborough Securities Asset-Backed Investments

Marlborough Securities has released a new opportunity for asset-backed investment within the UK property market. The investment, which revolves around secured property development loans in the south-east of England, offers a five-year fixed rate return of 9.25% to qualifying investors. This outperforms traditional correlated property-based investments in the UK, with an Interest Distribution of 46.25% over a typical five-year investment period.

Demand for UK property has been significant and growing in recent years. While this is good news for property developers, it drives down yields for investors. When partnered with changes to the UK tax regime, such as the introduction of taxation on buy-to-let, investors have been finding the property investment market more challenging. Marlborough Securities is working to help investors meet these challenges head-on and take advantage of existing market opportunities – as well as new and emerging opportunities – in an ever-changing market. The Marlborough Securities investment opportunity comes in the form of a fully asset-backed Bond supported by a proven and experienced team of advisors.

Andrew Green, founder of Grosvenor Bridging Loans Limited, is a key member of the Advisory Team. With a 25-year track record of success, Mr Green manages a clean book and has executed and redeemed over £300 million of loans with no defaults to date. In the last six months, Marlborough Securities has done £15 million of lending, with another £10 million pending on deals. The majority of these deals are only available for 18 months before being renewed.

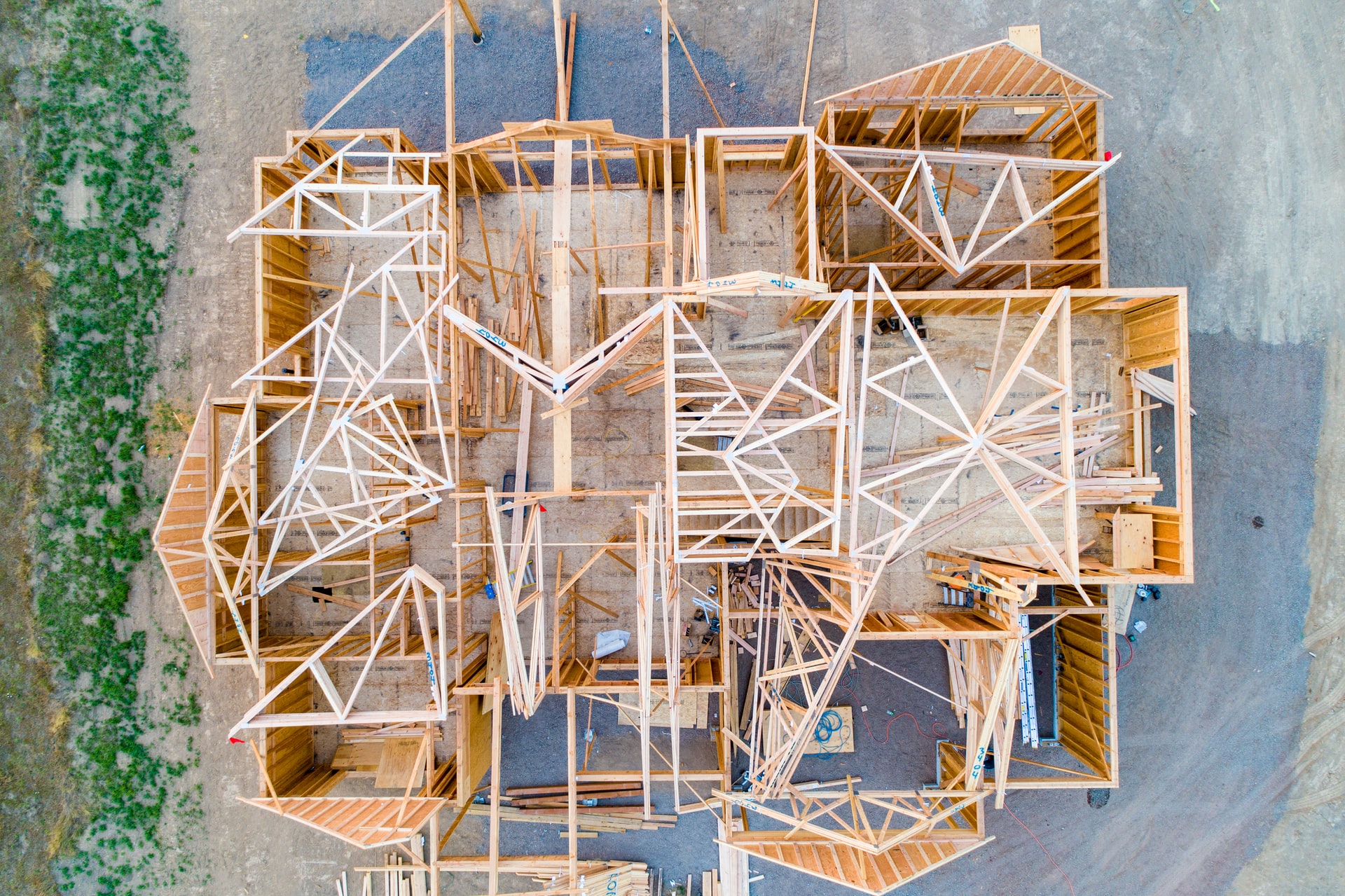

The Marlborough Advisory Team will be managing all monies raised through investment and working hand in hand with Marlborough Opportunities Limited. MOL will be providing seed financing for property development projects across the south-east of the UK, focusing on real estate development and construction. This financing will take the form of short-term, high-interest, over-collateralised bridging loans backed by the real and tangible assets of companies, shareholders, and principals, aimed at SMEs, development companies and investors.

The returns on the investment have a fixed rate for five years of 9.25% in GBP, or 8.5% and 8.0% in USD and euros respectively. There are no initial charges and 100% allocation, with tax-free gross payments of coupons and yields. The over-collateralisation on the underlying assets protects investor income distribution and delivers short-term returns that are above market average. There is no maximum investment subject to the maximum issuance of £50 million Marlborough Secured Notes, with a nominal value of £1,000 each (or $1,000 or €1,000), with a minimum investment threshold of £100,000.

Marlborough Securities is exploring a comprehensive property investment portfolio comprising both commercial and residential properties, with a focus on the lucrative south-east region of the UK. These include bridging loans to secure land for domestic property development, the expansion and development of bar and restaurant franchises, and the funding for a series of buy-to-let properties that have already generated much interest.