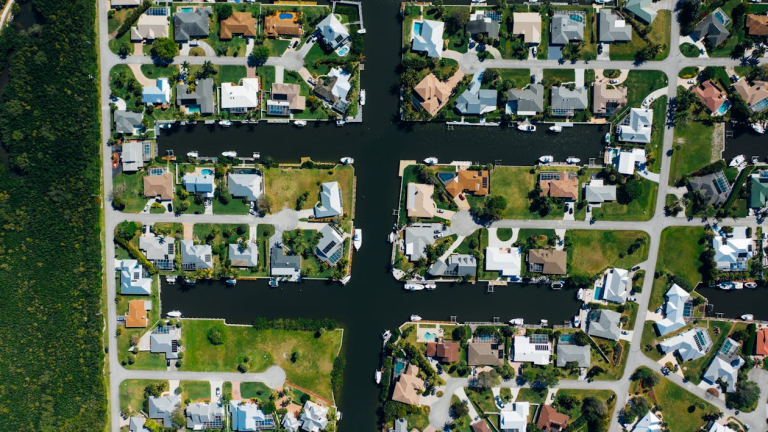

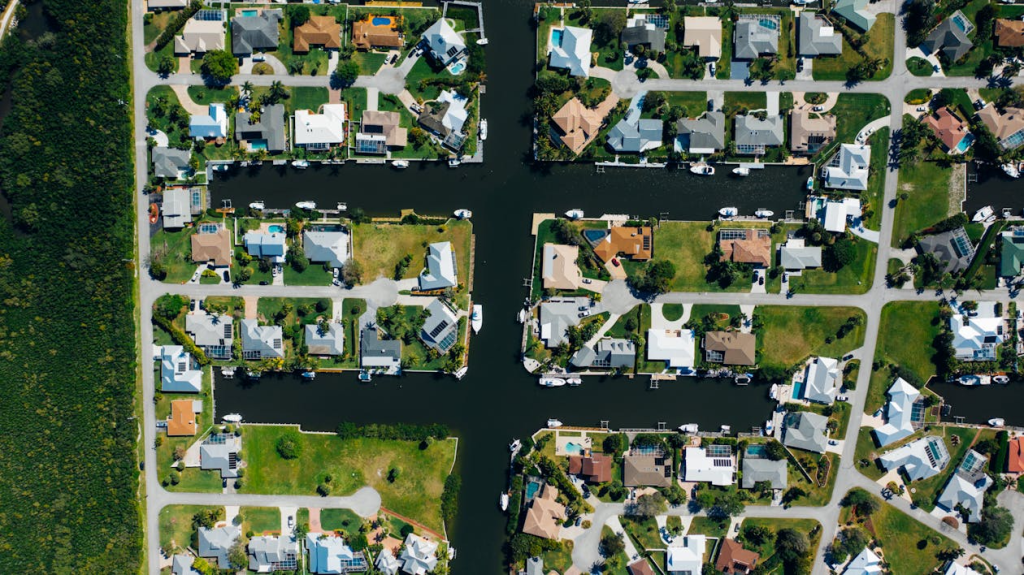

Lake towns in the U.S. have always held a special charm. They offer calm waters, natural beauty, and a lifestyle that gives away leisure with opportunity. For offshore investors, these towns are becoming much more than vacation spots. They are now attractive markets with extremely strong growth potential.

Big cities often dominate real estate headlines. But smaller towns, especially those near lakes, are gaining attention. Many remain affordable yet provide you with consistent rental demand. As an investor who looks beyond the obvious, you can find strong returns in hidden corners of America.

This guide highlights nine under-the-radar lake towns. Each one should offer a unique interest for you. From rental potential to long-term growth, we tell you about these towns that deserve a closer look.

Why Lake Towns Attract Offshore Investors

There are several reasons why international buyers turn to lake towns.

1. Lifestyle appeal

Lake living is desirable. You’ll see people craving weekend homes, vacation rentals, or permanent escapes. This steady demand makes investment safer. Be honest, you can’t risk the safety of things this big.

2. Affordability compared to big cities

Many lake towns are still cheaper than coastal metros. It lowers the entry cost for investors. Thus you can get an accessible market.

3. Tourism demand

Short-term rental platforms thrive near lakes. Seasonal visitors provide you constant rental income.

4. Appreciation potential

Since more families are moving away from big cities, it is no secret that demand for small-town living grows at a corresponding rate. Lake towns often see rising values.

5. Diversity of markets

From the Midwest to the South, each region offers you different price points and growth patterns. Offshore investors can balance their portfolios by choosing towns in multiple states.

9 Under-the-Radar Lake Towns

1. Lake Geneva, Wisconsin

Lake Geneva has long been a Midwest favorite. It is within driving distance of Chicago and Milwaukee. The town has always had a small-town charm. Then there are its upscale amenities. Thus, the properties here attract vacationers year-round. Short-term rentals do well during summer. In winter, the area still gets demand thanks to events and nearby skiing. Prices remain more reasonable than major coastal resorts.

2. Hot Springs, Arkansas

This lake town is what you call a historic place with natural beauty. Hot Springs is known for its thermal waters and surrounding lakes. The cost of living is lower than national averages. Rental demand is fueled because of tourism and retirees. As an investor, you’ll find both short-term and long-term tenants here. Waterfront homes remain more affordable compared to similar resort areas.

3. Coeur d’Alene, Idaho

Coeur d’Alene has been growing fast in recent years. The lake is famous for clear waters and outdoor recreation. Demand for homes has increased as remote workers and retirees move in. Prices are rising but still lower than large western cities. The town’s expanding economy supports long-term growth. Investors looking for appreciation should watch this market closely.

4. Lake Havasu City, Arizona

Known for its sunny weather, Lake Havasu is popular with boaters and retirees. The area attracts visitors from California and Nevada. Short-term rentals are in demand due to year-round tourism. Property taxes are relatively low. You’ll see that the prices are higher than some Midwest lakes. But still we recommend it because of the competitiveness it possesses compared to coastal cities.

5. Traverse City, Michigan

Traverse City sits on the edge of Lake Michigan. It has beauty, vineyards, and a growing food scene. Tourism is strong in summer, but the town also has year-round residents. Investors see opportunities in both vacation rentals and traditional leases. The market has been gaining attention. Moreover, it remains underpriced compared to bigger resort towns.

6. Lake Norman, North Carolina

Lake Norman lies just north of Charlotte. It is both a vacation appeal and commuter convenience. Many professionals choose to live here while working in Charlotte. That creates stable rental demand beyond tourism. The area has luxury homes but also mid-range options. Investors benefit from both short-term and long-term markets.

7. Sandpoint, Idaho

Sandpoint is smaller than Coeur d’Alene but equally charming. It sits by Lake Pend Oreille and is surrounded by mountains. Outdoor enthusiasts flock here for boating, skiing, and hiking. The town is gaining popularity among remote workers. Demand is increasing, but prices remain relatively affordable. For offshore investors, it represents an early entry market.

8. Osage Beach, Missouri

This town sits on the Lake of the Ozarks. It is a popular regional vacation spot with strong rental demand. Many families from Kansas City and St. Louis visit during summer. Properties here are more affordable than in many other lake towns. Investors can build strong rental portfolios without huge upfront costs.

9. Lake Beulah, Wisconsin

Lake Beulah sits just a few miles from the better-known Geneva Lake, but it has its own unique charm. The lake is smaller and quieter. This is why the ambience is more relaxed than usual. For offshore investors, that translates into lower entry prices and less competition.

The community is close to both Milwaukee and Chicago. This location benefits from steady tourism and vacation-home demand. Investors who get in now can take advantage of appreciation as awareness grows.

What Offshore Investors Should Keep in Mind

- Understand local regulations

Many U.S. towns regulate short-term rentals. Check permit rules and zoning before buying.

- Plan for property management

Offshore investors need reliable local managers. They handle maintenance, tenant issues, and compliance.

- Research financing options

Foreign buyers may face different lending rules. Some towns have banks that work with international clients, but cash purchases are often easier.

- Check tax implications

U.S. rental income is taxable. Work with accountants familiar with both U.S. and offshore rules.

- Diversify across regions

Don’t put all capital into one lake town. Balancing Midwest, South, and West investments reduces risk.

- Watch for seasonal shifts

Some lake towns depend heavily on summer. Others, like Big Bear or Sandpoint, have dual-season demand. Choose based on your income goals.

Conclusion

Under-the-radar U.S. lake towns have much for offshore investors. They have affordable entry, rental demand, and long-term growth potential. By acting early and choosing wisely, you can secure steady returns in America’s most overlooked waterfront markets!